In this tutorial we will write sample program to calculate federal personal income tax based on filing status and taxable income.

There are four filing statuses:

Single filers

Married filing jointly

Married filing separately

Head of household.

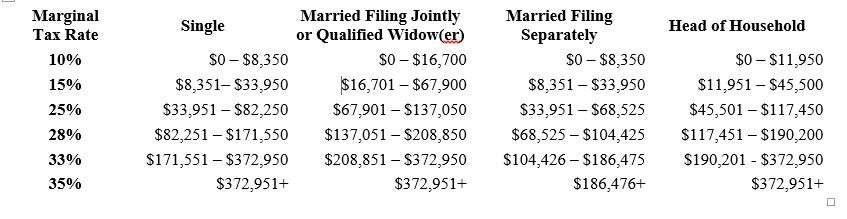

The tax rates vary every year. Shown in below table

You are to write a program to compute personal income tax. Your program should prompt the user to enter the filing status and taxable income and compute the tax. Enter 0 for single filers, 1 for married filing jointly, 2 for married filing separately, and 3 for head of household.

import java.util.Scanner;

public class CalculateTax {

public static void main(String[] args) {

Scanner input = new Scanner(System.in);

// This will prompt the user to enter filing status on console

System.out.print("Enter the filing status: ");

int status = input.nextInt();

// This will prompt the user to enter taxable income on console

System.out.print("Enter the taxable income: ");

double income = input.nextDouble();

double tax = getTax(status, income);

// Display tax result

System.out.println("Tax is " + tax);

}

public static double getTax(int status, double income) {

// Compute tax

double tax = 0;

switch (status) {

case 0: // Calculate tax for single filers

tax += (income <= 8350) ? income * 0.10 : 8350 * 0.10;

if (income > 8350)

tax += (income <= 33950) ? (income - 8350) * 0.15 :

25600 * 0.15;

if (income > 33950)

tax += (income <= 82250) ? (income - 33950) * 0.25 :

48300 * 0.25;

if (income > 82250)

tax += (income <= 171550) ? (income - 82250) * 0.28 :

89300 * 0.28;

if (income > 171550)

tax += (income <= 372950) ? (income - 171550) * 0.33 :

201400 * 0.33;

if (income > 372950)

tax += (income - 372950) * 0.35;

break;

case 1: // Calculate tax for married file jointly or qualifying widow(er)

tax += (income <= 16700) ? income * 0.10 : 16700 * 0.10;

if (income > 16700)

tax += (income <= 67900) ? (income - 16700) * 0.15 :

(67900 - 16700) * 0.15;

if (income > 67900)

tax += (income <= 137050) ? (income - 67900) * 0.25 :

(137050 - 67900) * 0.25;

if (income > 137050)

tax += (income <= 208850) ? (income - 137050) * 0.28 :

(208850 - 137050) * 0.28;

if (income > 208850)

tax += (income <= 372950) ? (income - 208850) * 0.33 :

(372950 - 208850) * 0.33;

if (income > 372950)

tax += (income - 372950) * 0.35;

break;

case 2: // Calculate tax for married separately

tax += (income <= 8350) ? income * 0.10 : 8350 * 0.10;

if (income > 8350)

tax += (income <= 33950) ? (income - 8350) * 0.15 :

(33950 - 8350) * 0.15;

if (income > 33950)

tax += (income <= 68525) ? (income - 33950) * 0.25 :

(68525 - 33950) * 0.25;

if (income > 68525)

tax += (income <= 104425) ? (income - 68525) * 0.28 :

(104425 - 68525) * 0.28;

if (income > 104425)

tax += (income <= 186475) ? (income - 104425) * 0.33 :

(186475 - 104425) * 0.33;

if (income > 186475)

tax += (income - 186475) * 0.35;

break;

case 3: // Calculate tax for head of household

tax += (income <= 11950) ? income * 0.10 : 11950 * 0.10;

if (income > 11950)

tax += (income <= 45500) ? (income - 11950) * 0.15 :

(45500 - 11950) * 0.15;

if (income > 45500)

tax += (income <= 117450) ? (income - 45500) * 0.25 :

(117450 - 45500) * 0.25;

if (income > 117450)

tax += (income <= 190200) ? (income - 117450) * 0.28 :

(190200 - 117450) * 0.28;

if (income > 190200)

tax += (income <= 372950) ? (income - 190200) * 0.33 :

(372950 - 190200) * 0.33;

if (income > 372950)

tax += (income - 372950) * 0.35;

break;

default:

System.out.println("You have enter invalid status and valid status are:\n" +

"0-for single filers\n" +

"1-for married filing jointly\n" +

"2-for married filing separately\n" +

"3-for head of household");

System.exit(1);

}

tax = (int) (tax * 100) / 100.0;

return tax;

}

}For more information please visit here